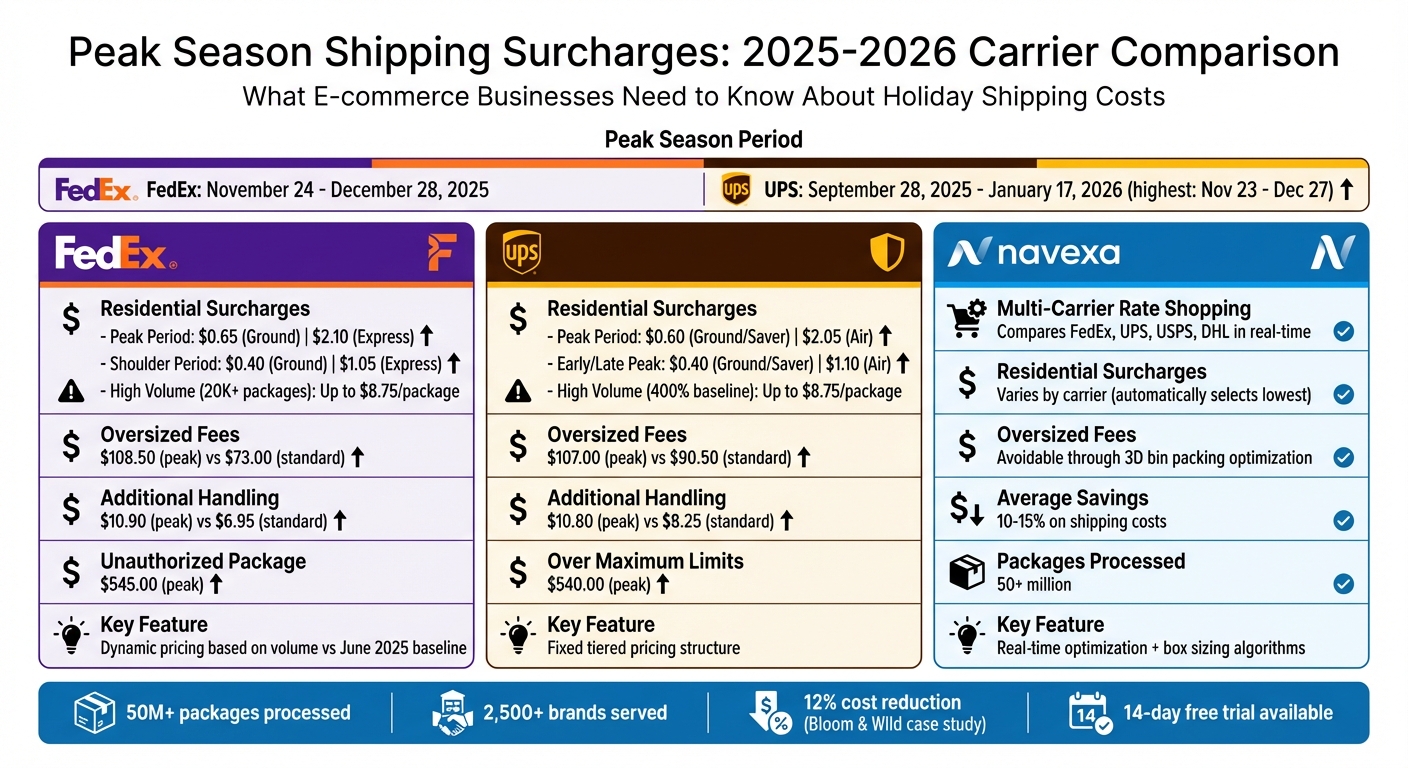

Carrier Surcharges During Peak Seasons: Comparison

Shipping during peak seasons can get expensive fast. Carriers like FedEx and UPS impose extra fees - called demand surcharges - when their networks face high volumes, especially during holidays. These fees apply to residential deliveries, oversized packages, and shipments needing special handling. For e-commerce businesses, this can eat into profits.

Here’s a quick breakdown of what to expect for the 2025–2026 season:

- FedEx: Residential surcharges range from $0.40 to $2.10. For high-volume shippers, fees can spike to $8.75 per package. Large package fees hit $108.50, with unauthorized package charges reaching $545.00 during peak periods.

- UPS: Residential delivery surcharges range from $0.40 to $2.05. Oversized package fees climb to $107.00, with maximum limits surcharges at $540.00.

- Navexa: Helps businesses save 10–15% by comparing real-time rates across carriers and optimizing packaging to avoid extra fees.

Quick Comparison

| Carrier/Platform | Residential Fees | Oversized Fees | Volume-Based Increases | Key Features |

|---|---|---|---|---|

| FedEx | $0.40–$2.10 | $108.50 | Up to $8.75 per package | Dynamic pricing based on volume |

| UPS | $0.40–$2.05 | $107.00 | Up to $8.75 per package | Fixed tiered pricing |

| Navexa | Varies by carrier | Avoidable | Avoidable | Real-time rate comparison, box optimization |

To cut costs, consider diversifying carriers, optimizing packaging, and using tools like Navexa to automate carrier selection and reduce fees.

FedEx vs UPS vs Navexa Peak Season Surcharge Comparison 2025-2026

2025 UPS Demand Surcharge Breakdown

1. FedEx

Analyzing peak season surcharges is crucial when comparing carriers, and FedEx’s adjustments provide a clear example of why.

Residential Delivery Surcharges

FedEx applies two distinct residential surcharges during peak season. Between November 24 and December 28, 2025, the surcharge is a flat $0.65 for Ground/Home Delivery and $2.10 for Express shipments. During the surrounding "shoulder" periods, these fees drop to $0.40 for Ground/Home Delivery and $1.05 for Express shipments.

For shippers handling more than 20,000 weekly residential packages, surcharges increase dynamically based on a "peaking factor" tied to a June 2025 baseline. For example, if holiday shipping volume climbs to 400% above the baseline, surcharges can reach as high as $7.50 per Ground package and $8.75 per Express package, in addition to standard rates.

"FedEx ties its residential delivery surcharges to shipping volume compared with a June 2025 baseline. The higher the weekly spike above baseline the higher the surcharge" – Robyn Meyer, Senior Vice President at Transportation Insight.

FedEx also adjusts surcharges for oversized and large packages during this period.

Large Package and Oversize Surcharges

As of January 12, 2026, FedEx introduced cubic volume thresholds to determine oversize surcharges. Packages exceeding 10,368 cubic inches are subject to Additional Handling fees, while Oversize Charges apply to those exceeding 17,280 cubic inches or weighing more than 110 lbs.

During the peak period from November 24 to December 28, 2025, Oversize Charges increased to $108.50, a 48.6% jump from the standard $73.00. Similarly, Additional Handling fees rose to $10.90, up from $6.95. Starting August 18, 2025, FedEx began rounding all fractional inches up for dimensional calculations. For packages exceeding maximum dimensions, the Ground Unauthorized Package Charge reached $545.00 during the peak season, compared to $490.00 during the shoulder periods.

Fuel and Processing Surcharges

On December 1, 2025, FedEx updated its fuel surcharge tables as part of MD-11 safety reviews. Additionally, a general rate increase averaging 5.9% was applied to package services starting January 5, 2026. Processing fees also saw changes, with the Disbursement Fee set at the greater of $15 or 2% of the combined duty, tax, and merchandise processing charges.

2. UPS

UPS organizes its peak season surcharges differently than FedEx, with the 2025–2026 period running from September 28, 2025, through January 17, 2026. The highest charges were applied between November 23 and December 27, 2025, which aligns with the busy holiday season. These adjustments are designed to address the increased shipping demands during this time. Let’s break down the fee structures for different service types.

Residential Delivery Surcharges

UPS applies residential surcharges to its Ground Residential, Air Residential, and Ground Saver services. During the early and late peak seasons, Ground and Saver shipments included a $0.40 surcharge, while Air services carried a $1.10 fee. However, during the core holiday period (November through December), these surcharges increased to $0.60 for Ground/Saver and $2.05 for Air services.

For shippers handling large volumes, costs can rise significantly. If shipment volumes exceed 400% of the June 2025 baseline, surcharges can climb as high as $8.75 per package.

"UPS tiered structure creates significant cost risk for high volume shippers. Going 200 percent over baseline can triple or quadruple per package fees."

– Robyn Meyer, Senior Vice President, Parcel Strategy & Solutions, Transportation Insight

Adding to the complexity, UPS announced these surcharges with less than one month's notice, a much shorter timeline compared to the several months’ notice provided in 2024.

Next, let’s look at how UPS handles fees for bulky shipments.

Large Package and Oversize Fees

During the 2025 peak season, fees for oversized packages and additional handling saw notable increases. The additional handling fee rose from $8.25 to $10.80, while large package surcharges jumped from $90.50 to $107.00 per shipment.

For shipments exceeding UPS's maximum size and weight limits, the "Over Maximum Limits" surcharge reached $540.00 per package during the busiest period. This was a significant increase from the $485.00 surcharge applied during the early and late peak seasons.

Fuel and Processing Surcharges

UPS adjusts fuel surcharges weekly based on U.S. Gulf Coast kerosene‐type jet fuel prices from two weeks prior. As of February 2, 2026, the Domestic Ground fuel surcharge stood at 21.00%, while the Domestic Air surcharge was 20.00%. During the 2025 peak season, these surcharges fluctuated between 30.25% and 33.00%.

Additionally, UPS announced a 6.1% increase in North American Air Freight rates, which took effect on December 22, 2025.

sbb-itb-ed0a9d1

3. Navexa

When FedEx and UPS ramp up their peak season surcharges, Navexa steps in to help e-commerce brands sidestep or reduce these extra costs. By comparing rates from USPS, FedEx, UPS, and DHL in real time, Navexa ensures businesses can automatically pick the most cost-effective shipping option. This means companies can shift shipments away from carriers with higher seasonal fees to those with lower or no surcharges, saving money where it counts.

Residential Delivery Surcharges

Navexa excels at comparing residential delivery fees across major carriers in real time. Its multi-carrier rate shopping feature identifies the carrier with the lowest residential premium for each package. For example, during the 2025–2026 peak season, businesses using Navexa could reroute shipments to USPS or smaller regional carriers with fewer fees.

"We ship 10,000+ orders daily and Navexa handles it flawlessly. The multi-carrier rate shopping is a game-changer."

– Marcus Rodriguez, VP of Logistics, Urban Outfitters

With over 50 million packages processed for more than 2,500 brands, Navexa users typically save 10–15% on shipping costs.

This capability paves the way for Navexa's advanced packaging solutions.

Large Package and Oversize Fees

Navexa uses 3D bin packing algorithms to optimize box sizes, helping businesses reduce dimensional weight charges and avoid hefty "Large Package" or "Oversize" surcharges. During the 2025 peak season, UPS charged $107.00, and FedEx charged $108.50 for oversized packages. Navexa's algorithms can help avoid these fees, sometimes by simply reducing a box's size by an inch.

Sarah Chen, Head of Operations at Bloom & Wild, shared her success story: Navexa cut her company’s shipping costs by 12% in just one month, thanks to its box optimization feature.

"Navexa cut our shipping costs by 12% in the first month. The box optimization alone paid for the entire platform."

– Sarah Chen, Head of Operations, Bloom & Wild

Fuel and Processing Surcharges

Navexa goes beyond just comparing base rates. It also factors in fuel and processing fees, giving businesses a complete view of their total shipping costs. This transparency helps companies make smarter, more informed shipping decisions.

Want to see these savings for yourself? Navexa offers a 14-day trial with no credit card required, letting businesses test its multi-carrier rate shopping and box optimization features before the next peak season hits.

Pros and Cons

When it comes to peak season shipping, understanding the strengths and weaknesses of each option is crucial for making informed decisions. Here's a breakdown of how FedEx, UPS, and Navexa stack up.

FedEx stands out in global air express with twice the number of planes as UPS and strong USPS partnerships for last-mile delivery. However, its surcharges for oversized and additional handling packages are higher than UPS, and it has a higher rate of package loss and damage. Another challenge is its dynamic "Peaking Factor" formula, which recalculates weekly, making cost forecasting more unpredictable.

UPS offers transparent, fixed tiered pricing based on a June baseline. It’s particularly cost-effective for standard shippers, with residential fees ranging from $0.40 to $0.60. But for high-volume shippers handling over 20,000 packages weekly, fees can climb sharply to as much as $7.50 per package when volumes exceed 400% of the baseline.

Navexa simplifies the decision-making process by comparing rates across FedEx, UPS, USPS, and DHL in real time. It automatically routes shipments to the most cost-effective carrier and uses intelligent box optimization to avoid oversized fees. Additionally, it provides complete cost visibility by including fuel and processing charges. The trade-off? Businesses must integrate with the platform and manage relationships with multiple carriers, though Navexa’s 50+ platform integrations help streamline this process.

Here’s a quick side-by-side comparison:

| Carrier/Platform | Key Strengths | Key Weaknesses |

|---|---|---|

| FedEx | Extensive air fleet; USPS last-mile delivery | High surcharges; unpredictable pricing |

| UPS | Clear tiered pricing; low residential fees ($0.40–$0.60) | Expensive for high-volume shippers (up to $7.50/package) |

| Navexa | Real-time rate comparison; 10–15% savings; box optimization | Requires integration; managing multiple carriers |

Each option has its niche. FedEx is ideal for urgent international shipments, UPS is better for predictable, moderate shipping volumes, and Navexa offers flexibility and cost savings for businesses needing multi-carrier solutions.

Conclusion

Peak season shipping doesn't have to drain your margins. While FedEx adjusts rates dynamically, UPS tends to impose higher fees for large volumes. Meanwhile, additional handling fees from both carriers often stay in a similar range.

To navigate these pricing structures, a well-thought-out shipping strategy is essential. Start by diversifying your carrier options - don’t rely exclusively on one provider. Fine-tune your packaging to avoid costly oversize fees caused by small measurement discrepancies. Leverage historical data to forecast your shipping volume and align it with each carrier’s baseline calculations, especially if you're shipping over 20,000 packages weekly.

Tools like Navexa can simplify these challenges. By comparing real-time rates from FedEx, UPS, USPS, and DHL, it automatically selects the most cost-effective option for each shipment. Its smart box optimization feature minimizes dimensional weight penalties, and full cost transparency ensures you won’t face unexpected fees during the busy Q4 season. On average, brands using Navexa cut shipping costs by 10–15%, with Bloom & Wild reporting a 12% reduction in their first month alone.

To further control costs, consider launching early-bird promotions to shift shipping demand away from the peak November 23–December 27 period, when surcharges can soar - for instance, high-volume residential fees may reach up to $8.75 per package. Position inventory strategically across multiple fulfillment centers to reduce the number of shipping zones. And don’t wait too long - according to TransImpact’s Brian Byrd, "In 2025, standing still means falling behind".

FAQs

What strategies can e-commerce businesses use to cut shipping costs during peak seasons?

Shipping costs can skyrocket during peak seasons, but there are smart ways for e-commerce businesses to manage these expenses.

One effective tactic is multi-carrier rate shopping. This involves comparing shipping rates from different carriers in real time, allowing you to choose the most cost-effective option for each order. It’s a simple yet powerful way to avoid overpaying.

Another strategy is intelligent box optimization. By selecting packaging that fits your products perfectly, you can reduce dimensional weight charges - those pesky fees based on the size of the box rather than its weight.

It’s also crucial to understand the various peak season surcharges, like residential delivery fees or extra handling charges. With this knowledge, you can plan shipments more strategically to avoid unnecessary costs.

Finally, using tools that automate shipping workflows and provide data-driven insights can help streamline operations. These tools not only save time but also ensure you’re making cost-effective decisions during high-demand periods.

What causes carrier surcharges to vary during peak seasons?

Carrier surcharges spike during peak seasons for several reasons. Periods like the holiday season bring a surge in demand, which drives up operational costs for carriers. Expenses related to staffing, transportation, and infrastructure all increase, and surcharges are a way to offset these added costs. Factors like the type of service, package size, destination, and specific delivery needs - such as residential or remote area deliveries - can influence the surcharge amount.

The timing and length of peak seasons also play a big role. Surcharges typically align with the busiest times, often from late November through December. During these months, capacity constraints, staffing shortages, and higher transportation costs all contribute to fluctuating surcharge rates. The combination of these factors makes surcharges vary significantly based on both demand and carrier operations.

How can Navexa help businesses reduce shipping costs during peak seasons?

Navexa makes managing shipping costs easier with its smart box optimization and multi-carrier rate comparison tools. By evaluating product dimensions, it identifies the best box sizes to minimize dimensional weight charges and avoid extra shipping costs. Plus, its real-time rate comparisons across top carriers help businesses pick the most budget-friendly shipping options for each package - even during busy seasons.

With easy integrations, automated processes, and detailed analytics, Navexa enables businesses to respond efficiently to changing carrier rates and seasonal demand. On average, users report saving 10-15% on shipping expenses, making it a powerful solution for streamlining fulfillment and handling seasonal surcharges with ease.

Ready to optimize your fulfillment?

Start saving on shipping costs and streamline your operations with Navexa.